The Connoisseur’s Defense: A Forensic Guide to How to Buy Wine at Auction Without Being Scammed

Strategic Foundations: Why Trust is the Rarest Vintage

Acquiring rare and fine wine represents the pinnacle of collecting, blending passion, history, and financial investment. The auction house remains the primary global engine for this market, offering access to coveted, hard-to-find bottles that may be entirely unavailable on the open market. For both the seasoned connoisseur and the novice collector, mastering how to buy wine at auction is essential for portfolio growth.

However, the allure of the auction room is matched only by its inherent risks. The secondary market is frequently plagued by high-profile counterfeits, intimidating estimates, and an array of sophisticated scams that have historically cost collectors millions. To mitigate these hazards, a rigorous, analytical approach to every transaction is mandatory. The core challenge for collectors is that, unlike standard retail transactions, the process often requires the buyer to accept the wine “as-is”. This fundamental condition shifts the burden of risk almost entirely onto the purchaser, demanding proactive, exhaustive due diligence rather than reactive consumer protection.

This necessary diligence is why companies specializing in secure acquisition and authentication, such as Vintage Cellar, have become indispensable partners. Vintage Cellar leverages an extensive global network to source rare bottles, but crucially, it provides the essential expert guidance needed to authenticate them, minimizing the possibility of unknowingly adding a fraudulent bottle to a collection.

The Modern Threat: The Evolution of Wine Fraud

Wine fraud is not a recent phenomenon; it has evolved alongside the wine trade itself. Historically, practices ranged from rudimentary clarification agents like dried fish bladders (isinglass) to outright deception, underscoring that the fight for authenticity is centuries old. However, the modern wine boom, especially for highly demanded regions like Burgundy and Bordeaux, has propelled the sophistication of fraud to unprecedented levels.

The surge in market value, often tracked by measures such as the liv-ex fine wine market indices (discussed in detail later), directly correlates with increased efforts by fraudsters. Contemporary counterfeiting involves meticulous work: using aged paper stock, forging period-accurate fonts, and employing stains, such as tea or wine residue, to simulate the “lived-in” look of authentic old labels. Because basic visual checks are frequently insufficient against such sophisticated trickery, collectors must rely on advanced wine auction expert advice and forensic technologies to truly verify a bottle’s legitimacy. A comprehensive strategy for how to buy wine at auction must therefore begin with the assumption of risk and proceed with forensic vigilance.

Market Mastery: Valuation and Economic Indicators

A critical component of avoiding scams and ensuring investment integrity is establishing an accurate wine auction valuation before bidding commences. Without a clear understanding of an asset’s true worth, collectors risk overpaying for common wines or paying a premium for compromised bottles.

The Critical Role of Wine Auction Valuation

The valuation of fine and rare wine is driven by multiple factors, beginning with the producer’s reputation and the specific vintage. The year of production is paramount; wines from “great” or “legendary” vintages those years characterized by optimal growing seasons, favorable weather, and low pest/disease issues can command significantly higher prices than those from “off” years. For example, certain aged bordeaux wine vintages like 1982 or 2000 are highly coveted due to their structural balance and proven aging potential. Rarity, determined by the original production quantity, also plays a critical role, as limited runs naturally increase market scarcity and value.

Beyond the contents, appraisers conduct a meticulous physical inspection to determine the current value. This review assesses the bottle’s ullage (the space between the liquid and the cork), which can indicate the wine’s exposure to air, and the condition of the label, capsule, and original packaging. Bottles retained in their Original Wooden Cases (OWC) or original cartons often command a higher price, reflecting a well-preserved history.

A peculiar complexity arises when assessing the label’s condition. While collectors often prefer pristine labels, a certain level of imperfection can actually be a positive indicator. A beat-up, dog-eared, or moldy label may suggest that the wine has been stored properly in a highly humid environment, which is ideal for long-term cellaring. Conversely, a label that appears overly clean or scrubbed might raise suspicions of tampering, suggesting attempts to conceal water damage or removal of fraudulent residue. This paradox requires nuanced wine auction expert advice that prioritizes the reason for the condition over mere cosmetic appearance.

To establish a competitive maximum bid, buyers must search for comparables (comps) using transactional data sites like wine-searcher.com or wineauctionprices.com. The actual fair market value is defined by the price a willing buyer pays an existing seller.

Utilizing the Liv-ex Fine Wine Market Indices

The sophisticated collector relies not just on single data points but on broad market indicators. The liv-ex fine wine market indices, operated by the London International Vintners Exchange (Liv-ex), serve as the most reliable indicator of global market sentiment and price movement.

Liv-ex distinguishes itself by basing its indices (such as the Fine Wine 1000 or the Burgundy 150) on verifiable, real-time transactional data the midpoint between the highest bid and the lowest offer standardized for 12x75cl trades. This methodology provides a much more robust reflection of market reality compared to list prices or estimates, which often lack the firm commitment of a transaction.

Monitoring these indices offers critical insight for navigating how to buy wine at auction. For example, the market experienced a significant boom between 2020 and 2022, followed by a subsequent “post-boom reset”. As of recently, many major Liv-ex indices, including the Champagne 50 and Burgundy 150, have pulled back to levels seen in early 2020. This knowledge allows collectors seeking the best Super Tuscan wines to collect or rare Burgundy to adjust their wine auction valuation estimates downward, enabling strategic acquisition opportunities in a softening market.

Financial Discipline: The Wine Auction Buyer’s Guide to Budgeting

The most frequently cited piece of wine auction expert advice is the necessity of maintaining strict financial discipline. Auctions are exhilarating environments, and it is easy for a buyer to get swept up in the competitive rhythm or the novelty of acquiring a rare bottle, leading to an overspend that could have been avoided by purchasing the wine cheaper elsewhere.

The essential rule in this wine auction buyer’s guide is to decide on a fixed, pre-researched maximum limit and stick to it, regardless of the temptation to engage in a bidding war. Furthermore, one must never overlook the buyer’s premium, a significant fee typically ranging from 20 to 25% that is levied on top of the final hammer price. A bottle secured at $1,000 quickly becomes $1,250 with the premium applied.

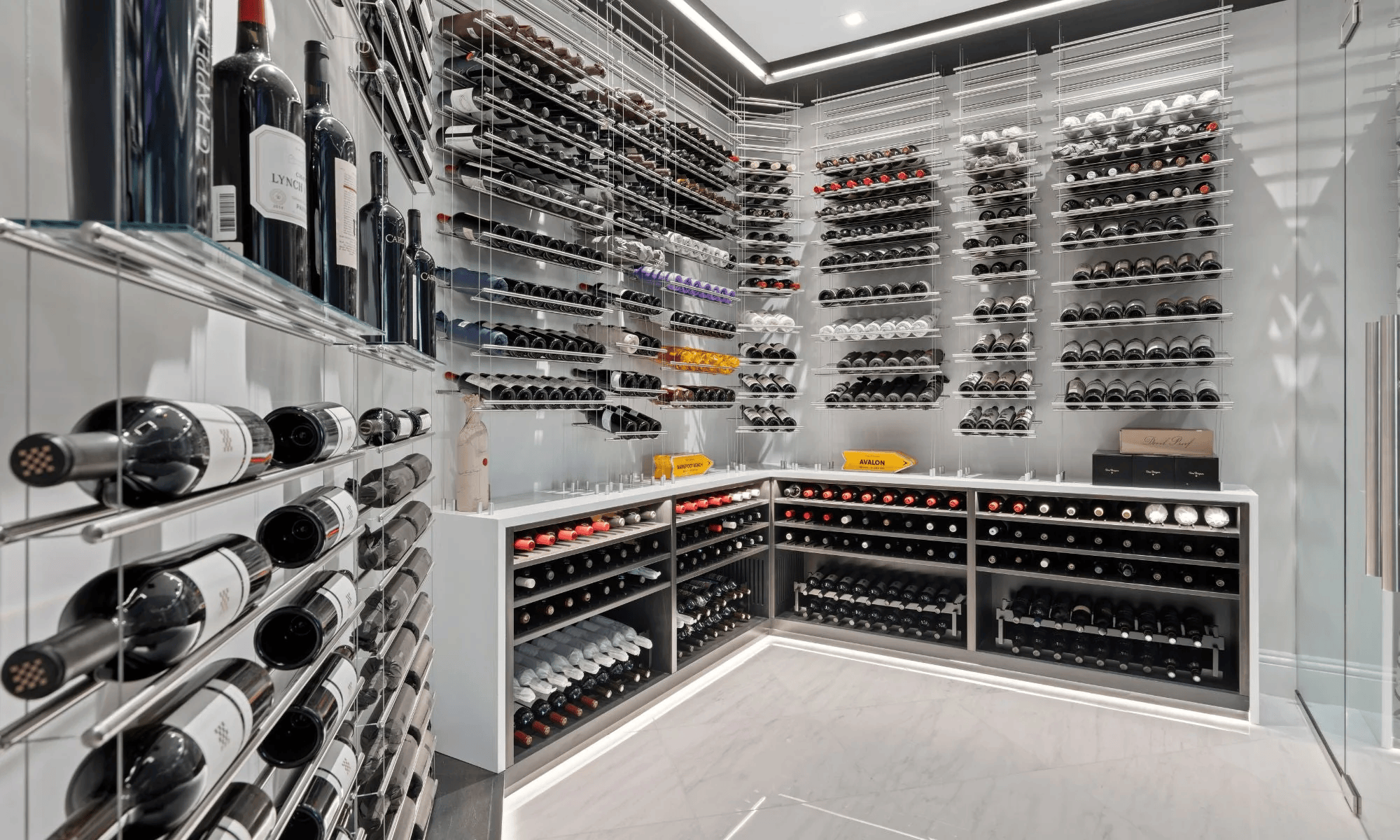

Finally, responsible wine investment due diligence must account for the total cost of ownership (TCO), which includes post-acquisition storage. If a wine’s valuation is contingent upon its long-term aging potential a core characteristic of collectible vintages failure to provide optimal storage conditions (a constant 12–14°C temperature and 70–80% humidity) will inevitably compromise its quality and degrade its future value. Partnering with a specialist like Vintage Cellar to secure professional, bonded storage immediately after acquisition is not merely a convenience; it is a compulsory step in maintaining the integrity of the investment.

The Provenance Wall: Rare Wine Provenance Check and Forensic Authentication

The single greatest defense against fraud and the core of mastering how to buy wine at auction securely is the verification of a bottle’s history, a process known as provenance checking.

Establishing the Chain of Custody

A successful rare wine provenance check establishes an unbroken chain of custody, tracing the bottle’s history of ownership, transit, and, most importantly, its storage conditions, ideally back to the original producer. This deep level of wine investment due diligence mitigates the risk of buying compromised or counterfeit stock.

Ideal storage conditions require consistency: temperature stability between 13–15°C (55–59°F) and humidity between 70–80%. If a wine is exposed to high temperatures, it will age rapidly and suffer damage, permanently diminishing its quality and value. Auction houses are expected to provide detailed provenance records, but if these records show gaps in custody or inconsistent storage environments, the risk profile of the bottle increases exponentially. Vintage Cellar understands this fundamental necessity, which is why it offers secure, bonded warehouse storage in regions such as Bordeaux, ensuring that the critical link of proper storage is maintained for the long term.

Forensic Visual Inspection: How to Spot Fake Wine at Auction

While technology is rapidly advancing, forensic visual inspection remains the first line of defense in determining how to spot fake wine at auction. Forgers utilize sophisticated methods, making minute details critically important:

- Label and Adhesive Analysis: Forgers meticulously replicate aged paper and period-appropriate inks. Suspicion should be directed toward unnatural staining or, conversely, paper that appears too “ultrawhite,” as newer paper stock or specific glues may fluoresce under blue light. The presence of white glue (a typical adhesive used post-1960s) or irregular glue residue around the label edges or beneath the capsule are often critical signs of tampering.

- Glass and Closures: Examining the bottle glass can provide definitive clues, especially for truly old vintages. Hand-blown bottles from the 19th century commonly exhibit a slight wobble when placed on a flat surface. French bottles produced after 1930 should typically have their capacity (e.g., 75cl) embossed somewhere on the glass. Any sign of tampering with the capsule or cork should raise an immediate red flag, as this is how many contents are replaced or refreshed.

- Ullage and Condition: Appraisers study the ullage (fill level) against established benchmarks for the vintage and bottle format. While a high fill is always reassuring, some expected ullage variation is normal for extremely old wines. However, excessive ullage or inconsistent fill levels across similar bottles in a lot warrant intense scrutiny.

Advanced Wine Auction Fraud Prevention Technology

Against the determined sophistication of modern forgers, traditional paper provenance and visual inspections are insufficient. Effective wine auction fraud prevention now requires leveraging integrated forensic and digital technologies.

Blockchain and NFC for Immutable Provenance

A revolutionary approach to securing the supply chain is the integration of Blockchain and Near-Field Communication (NFC) technology. This process involves creating a unique, tamper-proof digital identity, often referred to as a Digital Cork™ token, for every physical bottle. This token is linked to the physical bottle via secure authentication technologies such as NFC chips or secure QR codes, which are built to detect physical tampering.

The resulting record, immutable and continuously authenticated on the blockchain, establishes an unbroken chain of custody from the initial bottling date. This system solves the greatest vulnerability in the secondary market: verifying the bottle’s history between the vineyard and the collector. For high-value assets like the best Super Tuscan wines to collect or rare Burgundy, prioritizing bottles secured with these technologies offers the highest degree of security and ease of rare wine provenance check.

Forensic Fingerprinting and AI Authentication

In addition to tracking the bottle, science can now verify the liquid itself. Companies utilizing forensic science, such as Oritain, can analyze the unique ratio of elements absorbed from the soil into the grapes. This process creates a scientific “fingerprint” that links the finished wine back to its precise geographical origin, a link that remains stable throughout the wine’s lifespan. This capability serves as a powerful deterrent against the refilling of authentic bottles with fraudulent contents.

Furthermore, artificial intelligence (AI) is transforming sensory analysis. Research has demonstrated that AI algorithms, trained on chemical analysis methods like gas chromatography, can trace a bottle of wine back to its original vineyard and vintage with remarkable accuracy (up to a 99% success rate in identifying the estate in some Bordeaux studies). This emergence of digital olfaction and chemical fingerprinting provides an objective, technology-driven layer of verification that fundamentally strengthens wine auction fraud prevention.

The combination of digital authentication (Blockchain/NFC) and chemical fingerprinting creates a premium, secure market segment. As more producers adopt these measures, verified wines will likely command a growing premium, reflecting the enhanced security and simplified wine investment due diligence they offer. Collectors should recognize that auction houses that resist adopting or demanding these technologies are inherently transferring greater risk to the buyer.

The table below summarizes the key areas of forensic investigation crucial for a high-level rare wine provenance check when determining how to buy wine at auction:

| Assessment Area | Key Indicator | Red Flag (Potential Fraud/Fault) |

| Provenance Documentation | Traceable history (ownership/storage) back to the producer; professional, bonded storage preferred. | Gaps in custody; lack of professional storage records; exposure to high temperatures. |

| Label Integrity | Expected aging signs; period-accurate paper/ink. | Ultrawhite paper or modern printing; white glue fluorescing under blue light; suspicious glue stains under the capsule. |

| Bottle Condition | Appropriate glass weight/type for the era; capacity embossed (post-1930 French); hand-blown wobble on old vintages. | Scrubbed or cleaned bottles; modern machine-made glass used for older vintages; signs of capsule tampering. |

| Authentication Technology | Presence of secure NFC tag, blockchain token (Digital Cork™), or forensic marking (e.g., Oritain). | Absence of modern authentication methods on contemporary, high-value bottles. |

Execution Strategy: The Wine Auction Buyer’s Guide for Bidding

Executing a successful acquisition requires strategic planning, whether bidding in a packed auction room or navigating a digital platform. The practical elements of this wine auction buyer’s guide focus heavily on maintaining control and conducting thorough digital background checks.

Navigating Live and Digital Venues

The emotional energy of a live auction can be intoxicating, yet highly dangerous for the disciplined collector. Many experts recommend that those seeking how to buy wine at auction attend in person to “read the room” to gauge the urgency and buzz but utilize an auction house’s application or a phone bid to maintain distance and strictly adhere to their predetermined maximum bid.

For the online wine auction guide environment, several strategies can be employed to optimize success while mitigating risk:

- Fixed Maximum Bid Strategy: The simplest and safest approach is determining a maximum bid limit based on the objective wine auction valuation and refusing to exceed it, regardless of the competition.

- Incremental Bidding Strategy: Starting low and increasing the bid incrementally allows the buyer to control the bidding pace and potentially secure the lot just below the maximum valuation.

- Proxy Bidding: Most online platforms offer proxy bidding, where the system automatically increases the bid on the buyer’s behalf up to the specified maximum limit. This method helps secure the lot efficiently without constant monitoring.

The Specialized Online Wine Auction Guide: Digital Due Diligence

The rise of the digital marketplace has simplified access but amplified the need for wine investment due diligence. Not all online wine auction platforms are created equal, and some may lack the rigorous evaluation standards necessary for rare vintages.

A key piece of wine auction expert advice is the need to thoroughly vet the reputation of the auction house itself, checking industry forums and historical performance. It is essential to choose houses that commit to rigorously evaluating their consignments, including prior storage history and condition reports.

The critical element of digital due diligence is mastering the fine print. The Terms and Conditions (T&Cs) of every auction house vary substantially and must be read meticulously. T&Cs dictate the resolution of bidding disputes where the auctioneer typically maintains sole and absolute discretion to adjudicate or even rescind a bid.

Furthermore, the “as-is” caveat is central to the risk calculation of how to buy wine at auction. Reputable houses are diligent in reporting the physical condition of the bottle (label, fill level, storage), yet they cannot guarantee the drinking quality of the aged wine. The buyer must accept the risk that a bottle may be corked or past its peak maturity. Because post-purchase recourse can be administratively difficult and subject to the auctioneer’s final decision, comprehensive rare wine provenance check and authentication before the sale are the buyer’s greatest safeguards.

Post-Acquisition and Legal Safeguards of Wine at Auction

Wine Investment Due Diligence: Secure Storage and Preservation

The completion of a successful bid marks the end of the acquisition phase but the beginning of the preservation phase. Maintaining the asset’s value requires unwavering commitment to proper storage. This commitment is a non-negotiable component of ongoing wine investment due diligence.

The industry standard demands storage that minimizes light, vibration, and temperature flux, keeping the wine in the ideal range of 13–15°C with 70–80% humidity. Many investors and collectors opt for professional, bonded warehouses such as those offered by Vintage Cellar because they provide verified, professional, climate-controlled environments. Relying on these professional storage solutions protects the provenance trail and ensures that the meticulously planned wine auction valuation of the wine is preserved for its entire aging potential.

Legal Recourse: Fraud, Recission, and Litigation

Despite rigorous wine auction fraud prevention efforts, the risk of acquiring a counterfeit, however remote, persists. Understanding the legal landscape provides the final layer of defense for those who master how to buy wine at auction.

While auction house liability can be limited, and disputes are often governed by the T&Cs, fraudsters who knowingly consign counterfeit goods are vulnerable to legal action. Notable cases confirm that buyers can successfully sue sellers for fraudulent misrepresentation, resulting in compensatory damages (recovery of the purchase price) and, in egregious cases, significant punitive damages.

Some leading auction houses have recognized the need to instill buyer confidence and have implemented limited warranties that address alleged counterfeits. These guarantees typically require the buyer to return the wine in its original condition so that the house’s experts can conduct an independent forensic examination. For the sophisticated collector, prioritizing auction houses that offer such clear, written guarantees of authenticity provides an additional measure of security.

The Collector’s Focus: Investment-Grade Regional Deep Dive

The ability to successfully invest in fine wine requires both a defensive strategy against fraud and an understanding of the key investment categories driving the secondary market, which are closely monitored by the liv-ex fine wine market indices. The following sections provide focused wine auction expert advice on three globally dominant collection categories.

The Endurance of Aged Bordeaux Wine

Bordeaux, particularly its Grand Cru Classé vintages, stands as the cornerstone of fine wine collecting. The appeal lies in the wine’s remarkable ability to evolve over decades. As an aged bordeaux wine matures, its primary fruit flavors gracefully recede, yielding to complex, tertiary attributes such as cedar, tobacco, leather, and earthy notes. Investors target specific vintages such as 1982 or 2000 known for their exceptional balance and long-term potential.

Critical to preserving this potential is flawless cellaring. As noted previously, the ideal consistent temperature (12–14°C) and humidity (70–80%) are mandatory. Even minor fluctuations can accelerate the aging process detrimentally. A robust rare wine provenance check for aged bordeaux wine must therefore prioritize verified professional storage for the duration of the wine’s life.

For collectors planning to enjoy their acquisition, specialized rare vintage wine pairing advice is beneficial. Left Bank Bordeaux, typically Cabernet Sauvignon-dominant, features firm tannins and robust flavor, demanding powerful counterparts such as grilled red meats, game (like venison), or hard, aged cheeses. Conversely, Right Bank Bordeaux, often Merlot-dominant, presents a softer, fruitier profile that pairs wonderfully with roasted poultry, mushroom-based recipes, or semi-soft cheeses.

Collecting Powerhouses: The Best Australian Shiraz

Australian Shiraz provides a powerful alternative to traditional Old World styles, offering high quality and significant investment appreciation. While quality Shiraz is produced across the continent, the best Australian Shiraz from Barossa Valley is universally celebrated for its intensity, bold character, and rich dark fruit notes. The historical significance of Barossa, dating back to 1842, contributes to its global reputation.

However, a savvy collector should diversify beyond the Barossa Valley. Other critical Australian regions producing the best Australian Shiraz include:

- Hunter Valley: Recognized as the birthplace of Australian wine.

- McLaren Vale: Known for wines grown in close proximity to the rugged coastline.

- Heathcote: Celebrated for Shiraz that thrives in ancient Cambrian soils, lending a distinctive iron-like minerality and a flavor profile that leans toward rich dark fruit and spice.

When considering rare vintage wine pairing, the powerful structure and high concentration of a top best Australian Shiraz from Barossa Valley stand up to equally intense cuisine, making it an excellent match for dishes like braised goose legs or hearty, slow-cooked red meat ragus.

Italian Icons: The Best Super Tuscan Wines at Auction to Collect

The best Super Tuscan wines to collect emerged from a revolutionary period in Italian winemaking where producers deliberately blended indigenous Sangiovese with international, non-traditional grapes such as Cabernet Sauvignon, Merlot, and Syrah, often classifying them outside the strict DOC/DOCG rules. These wines now command high prices globally and are often classified as IGT (Indicazione Geografica Tipica) or, in the case of specific coastal areas, Bolgheri DOC.

Investment-grade examples of the best Super Tuscan wines to collect include iconic labels such as Sassicaia, Masseto, and Solaia. When conducting wine investment due diligence for these wines, confirming the specific producer and the vintage’s critical acclaim is essential, as is ensuring robust rare wine provenance check documentation, particularly given their high market demand.

For rare vintage wine pairing, Super Tuscans are highly versatile. The Sangiovese foundation makes them exceptional companions for traditional Tuscan cuisine, particularly rich dishes involving braised beef or veal, savory sausage and white bean recipes, or regional cheeses like Pecorino.

| Wine Category | Primary Characteristics | Investment Due Diligence Focus | Rare Vintage Wine Pairing Suggestion |

| Aged Bordeaux Wine (Left Bank) | Cabernet dominance; tertiary notes of cedar/tobacco; profound longevity. | Verify storage history (12–14°C, 70–80% humidity); meticulous ullage assessment. | Grilled red meats, game, and dishes featuring truffles. |

| Best Australian Shiraz (Barossa Valley) | Bold, rich, dark fruit, and spice; intense flavor profile. | Verify producer reputation and specific regional provenance (e.g., Barossa, Hunter, or Heathcote). | Powerful red meat dishes, such as braised goose or rich stews. |

| Best Super Tuscan Wines to Collect | International blends (often IGT/Bolgheri DOC); high critical acclaim and investment value. | Provenance tracking due to high demand; confirm IGT classification and acclaimed producer/vintage. | Traditional Tuscan fare: braised beef, rich sausage dishes, and regional Pecorino. |

Conclusion: Securing Your Future Collection with Vintage Cellar

The process of mastering how to buy wine at auction without being scammed is a sophisticated endeavor that demands preparation, market knowledge, and forensic rigor. Success depends on moving beyond emotional impulses and embracing disciplined wine investment due diligence.

The informed collector must begin by conducting objective wine auction valuation based on transactional data provided by sources like the liv-ex fine wine market indices. Next, they must prioritize the rare wine provenance check, moving beyond simple visual inspection to demanding full custody records and ideally seeking bottles protected by advanced wine auction fraud prevention technologies like Blockchain and forensic fingerprinting. Whether acquiring historical examples of aged bordeaux wine, the powerful best Australian Shiraz from Barossa Valley, or highly sought-after bottles of the best Super Tuscan wines to collect, this integrated defensive strategy is essential.

While the “as-is” nature of the market places significant risk on the buyer, partnership with a trusted advisory firm provides a robust defense. Vintage Cellar offers comprehensive services spanning from customized collection building and acquisition sourcing to expert authentication and secure, bonded storage in facilities like those in Bordeaux. By relying on the wine auction expert advice provided by Vintage Cellar, collectors can navigate the complexities of the secondary market with confidence, ensuring that their acquisitions are not only valuable additions but also verified, secure assets designed for long-term appreciation and exquisite rare vintage wine pairing enjoyment. The key to successful acquisition is knowledge, discipline, and the highest standards of due diligence, making every acquisition secure. For any more information, contact us here and we’ll connect you to our specialists,.